Closing Out a Decade

There are only a few days remaining in 2019. By mid-week, we will be ringing in a new year and new decade! It was quite an eventful year in the markets and for news, in general. Before diving into market-speak, it seems only fitting to take a quick look back at some of the major news headlines of 2019.

We began the year with a government shutdown, which definitely injected uncertainty into how the year would unfold. The Clemson Tigers won the College Football National Championship and were honored at the White House with a fast food spread since the government employees were on furlough. The shutdown lasted 35 days, the longest in US history, before an accord was met. The college admission scandal, involving fraud and widespread bribery at elite US universities, made news and Boeing’s 737 Max aircraft were grounded by the FAA. This was just the first quarter of the year!

In April, the Notre Dame Cathedral in Paris tragically caught fire. The British Royal Family welcomed Archie, the first child of Price Harry and wife, Meghan. There were ‘traffic jams’ on Mount Everest due to overcrowding while there was also congestion at the National Spelling Bee as eight co-champions were crowned because organizers “ran out of words.” The first Democratic presidential debate closed out the second quarter.

As the summer heated up, Robert Mueller testified on Capitol Hill regarding his recently concluded investigation into Russian election interference in 2016. Boris Johnson replaced Theresa May as Britain’s Prime Minister and the US women’s soccer team won their fourth World Cup, which brought the gender pay issue back into the spotlight. A couple of horrific mass shootings temporarily reignite gun control discussions in the US while across the Pacific, the pro-democracy protests in Hong Kong continued to intensify. As summer gave way to autumn, there was a bit of a dispute as to the projected path of Hurricane Dorian which impacted the east coast, sparing Alabama.

The last quarter began with a first, as an all-female spacewalk was conducted outside the International Space Station. Unfortunately, fires spread and burned across the state of California for several weeks causing massive amounts of damage while Venice, Italy faced its worst flooding in 50 years. After dragging on for several years, it appears Brexit is moving forward and the US House of Representatives voted to formally impeach President Trump. There is no doubt 2019 was an eventful year for news and also for the markets!

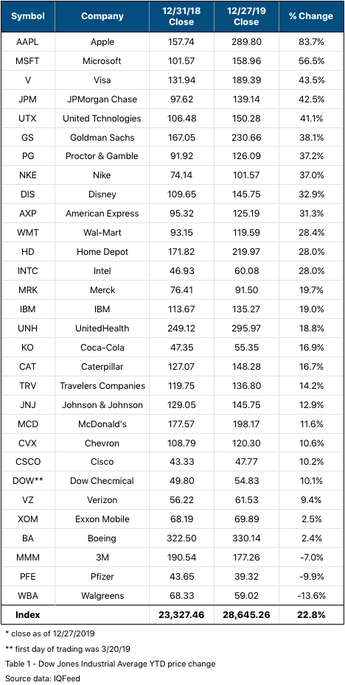

Darlings of the Dow

The final quarter of 2018 had investors in panic mode as the major indices sold off; giving up all of the gains of the year and closing in the red. The Standard and Poors 500 index closed down 6.2% for the year - all of the losses coming between October and December. Predictions from the pundits varied wildly and investors were not sure what to make of the situation as 2019 was rung in. On the afternoon of January 2nd, Apple (AAPL) revised their earnings guidance due to lack of iPhone upgrades and headwinds in China. Obviously, this sent shockwaves through the markets as investors punished Apple, taking the rest of the market with it.

The markets quickly gained their composure and the 3rd of January turned out to be the lowest point for the markets all year. In fact, the markets rose out of the trough of late 2018 with gusto and by early May the S&P 500 was making new all-time highs. As we entered into the summer months, the markets entered into a choppy zone as uncertainty of the trade war with China weighed heavily. The last quarter of the year was strong and the major indices are near all-time highs with two trading days remaining.

Remember that revised Apple guidance mentioned earlier? Well, Apple went on a tear and YTD is up 83.7% posting the largest percentage gain of the Dow Jones Industrials (DJI). In fact, of the thirty companies comprising the index, all but three posted gains on the year. Even Boeing (BA), who faced significant turbulence after the 737 Max fleet was grounded is slightly up on the year, despite being down over 100 points from March highs. Twenty-four of the DJI companies posted double-digit gains YTD as the index itself has risen 22.8% YTD. Table 1 details out the performance of the DJI companies.

Turning our attention from the thirty companies of the DJI into the broader market, the S&P 500 gains on the year jump to 29.2% YTD. Referencing a table published in a recent newsletter, Bulls on Parade, illustrates this year falls in second to 2013 (+29.6%) as the largest percentage gains of this century. 2003 (+26.4%) had the third largest percentage gains so far of the 2000s.

Delving a little deeper into the breakdown of 2019 shows only two months - May and August - with declines. The other ten months averaged just over 3.5% gains.

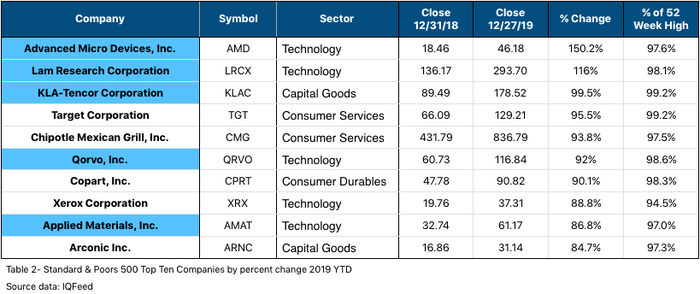

Drilling even further into the 500 individual companies that comprise the S&P 500 index, we see that Apple, the darling of the DJI, does not even make it into the top ten in terms of percentage gains; Apple, with its 83.7% YTD gains on the year is number eleven.

With 150% increase YTD, the company making the strongest move of 2019 is Advanced Micro Devices (AMD), who makes computer processor chips. In fact, half of the top ten performing companies are in the semiconductor space (highlighted in blue in Table 2 below).

If we dial back a couple of decades, the semiconductor sector helped fuel much of the market gains of the late 1990s - the strongest time (from a percentage growth perspective) in history. Carrying this leading indicator momentum into the new decade is definitely a positive sign.

Not all sectors are created equally

The universe of equities is vast and finding the best candidates for one’s portfolio can be tricky. One effective method of narrowing down the pool of investment candidates is to hone in on a particular sector that is performing well and select the strongest companies from within that sector. Conversely, investors can avoid underperforming sectors as well. We will delve into this topic a little more in a future newsletter.

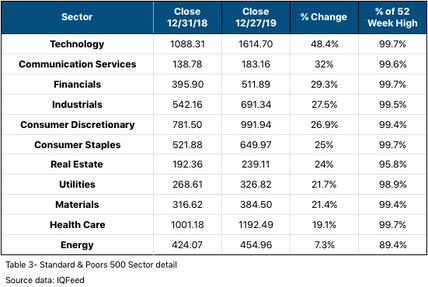

Looking into the eleven sectors of the S&P 500, there is no surprise Technology performed the best in 2019 with nearly

50% appreciation. The top performers of both the DJI and S&P 500 belong to this sector. Table 3 provides more detail into YTD performance of the sectors.

Referencing Table 1 above, the top performing companies tie to the top performing sectors Apple (AAPL) and Microsoft (MSFT) [technology] are followed by several large financial institutions, Visa (V), JPMorgan Chase (JPM), and Goldman Sachs (GS).

2020 Vision

This time of year always brings out the experts and their crystal balls. The news headlines seem to be all over the place, ranging from “the bubble is definitely going to burst in 2020” to “hang on, we’re just getting started and 2020 is going to be better than 2019!” This author has formed an opinion about where the markets head in the new year and will soon share in a future newsletter.

For now, here are some things to keep in mind as we prepare to flip over the calendars:

- Predicting the future is extremely difficult; no one truly knows what will happen.

- The markets tend to want to do the same thing they have been doing as the markets are heavily driven by herd mentality.

- This bull market is ten years old and may be tired but long-term trends are rarely changed on an acute move; usually there is consolidation and topping chart action signaling a change in trend (this is not currently happening.)

- Averaging out all 500 S&P companies, the average percentage of 52-week high is 91%, a bullish indicator

- 2020 is an election year and election years of a first-term president generally tend to rise into an election but can be volatile.

- The Federal Reserve policy is currently favorable to market investors.

- The technology sector looks strong and will likely remain so.

- The financial and health care sectors are also strong but are losing energy.

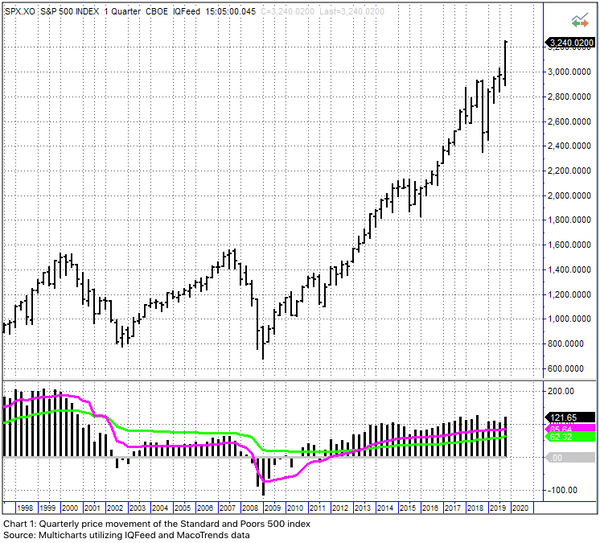

Chart 1 below might offer parting perspective. It is a quarterly S&P 500 index chart. The next year, 2020, will print only

four

new bars on the chart. The long-term uptrend is currently very strong and the underlying strength, while weakening on shorter time-frames, does not paint a picture of an all-out crash in the new year to this analyst. A stronger first half giving way to sideways consolidation is a definite possibility. Again, a more detailed look into the future will be offered soon.

In closing, this author and Momentum Private Wealth Management are excited for the opportunities that are sure to unfold in 2020. The New Year is a perfect time to review your portfolio and talk to a professional you trust to ensure your investments are working toward your long-term goals. The most important thing is to have a solid plan. If you currently have no plan or feel your current plan can be improved, MPWM can help!

Here’s to your health, wealth, and happiness in the coming year and decade.

If you are not having frequent conversations with your wealth or investment advisor about market strategies, investment management, or financial planning opportunities, you should be. Momentum Private Wealth Management specializes in Wealth Management as well as Comprehensive Financial Planning. Feel free to reach out to Austin directly at 512.416.8085 or austin@momentumpwm.com. You can also find out more information about MPWM at:

www.momentumpwm.com.

Justin Toedtman is a market strategist and contributing editor to Momentum Private Wealth Management. For the last 20 years, his focus has been on technical analysis and market strategies.

The information on this site is provided “AS IS” and without warranties of any kind either express or implied. To the fullest extent permissible pursuant to applicable laws, Momentum Private Wealth Management, LLC (referred to as “MPWM”) disclaims all warranties, express or implied, including, but not limited to, implied warranties of merchantability, non-infringement, and suitability for a particular purpose.

MPWM does not warrant that the information will be free from error. None of the information provided on this website is intended as investment, tax, accounting or legal advice, as an offer or solicitation of an offer to buy or sell, or as an endorsement of any company, security, fund, or other securities or non-securities offering. The information should not be relied upon for purposes of transacting securities or other investments. Your use of the information is at your sole risk. Under no circumstances shall MPWM be liable for any direct, indirect, special or consequential damages that result from the use of, or the inability to use, the materials in this site, even if MPWM or a MPWM authorized representative has been advised of the possibility of such damages. In no event shall MPWM have any liability to you for damages, losses, and causes of action for accessing this site. Information on this website should not be considered a solicitation to buy, an offer to sell, or a recommendation of any security in any jurisdiction where such offer, solicitation, or recommendation would be unlawful or unauthorized.

Our office serves the entire Austin Texas area, including:

Austin, Cedar Park, Georgetown, Leander, and Round Rock.

All Rights Reserved | Momentum Private Wealth Management

Website by EGS Marketing Solutions